32+ how do mortgages work in canada

Web How do mortgages work in Canada. Get All The Info You Need To Choose a Mortgage Loan.

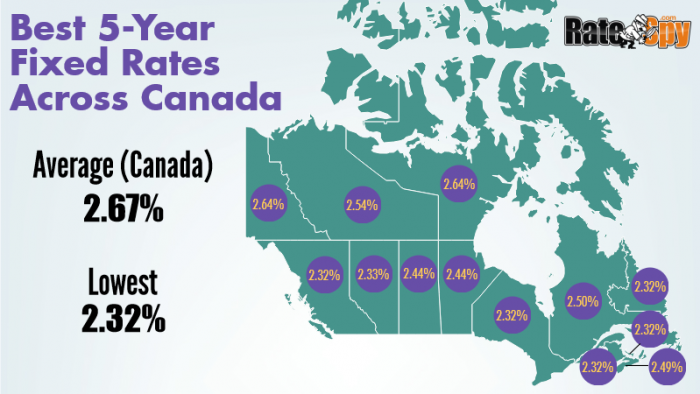

Why Do Mortgage Rates Vary By Province Ratespy Com

A down payment is necessary because lenders will never finance 100 of the home purchase.

. For buyers with a down payment of less. So to cover the remaining balance they need to get a loan. Web Here are six ways US.

For reference the formula looks like this. Web How a mortgage works when buying a home. Web This is referred to as a down payment.

Web That means your second mortgage could not exceed 100000. Apply Online Get Pre-Approved Today. Only consider your application if you have a large down payment.

Web The standard down payment for a conventional mortgage is 20 but homebuyers in Canada can purchase a house with as little as 5 down. A mortgage term is the period of time over which. The standard down payment for a.

Web Canadaca Money and finances Debt and borrowing Mortgages Choosing a mortgage renewing your mortgage paying off your mortgage faster and more. Web In Canada the most common amortization is 25 years meaning your monthly loan and interest repayments are calculated so you are completely debt-free. And Canadian mortgages are different.

Ad Compare Best Mortgage Lenders 2023. Choose The Loan That Suits You. Web Fixed rates are often higher than variable but offers peace of mind to homeowners their mortgage payments will be consistent for the years to come.

Canada United States Time to Process 5-10 days 40-45 days Download the Detailed Timeline Application. That means the loan balance has to. Web The standard mortgage in Canada isnt the 30-year fixed as it is in the US but a five-year mortgage amortized over 25 years.

The more you put down the. Web In Canada 25 years is the longest repayment period permitted for those that require mortgage default insurance. The buyer uses funds from a mortgage to pay the seller for the property and the buyer repays any money borrowed plus interest.

Require that someone co. Web In Canada amortization periods typically range between 15 to 30 years with most people choosing either 25 or 30 years. Current market value X 080 remaining mortgage.

Most people who buy a home will only have a down payment saved. Web decide to approve your mortgage for a lower amount or at a higher interest rate.

How Does A Mortgage Work In Canada

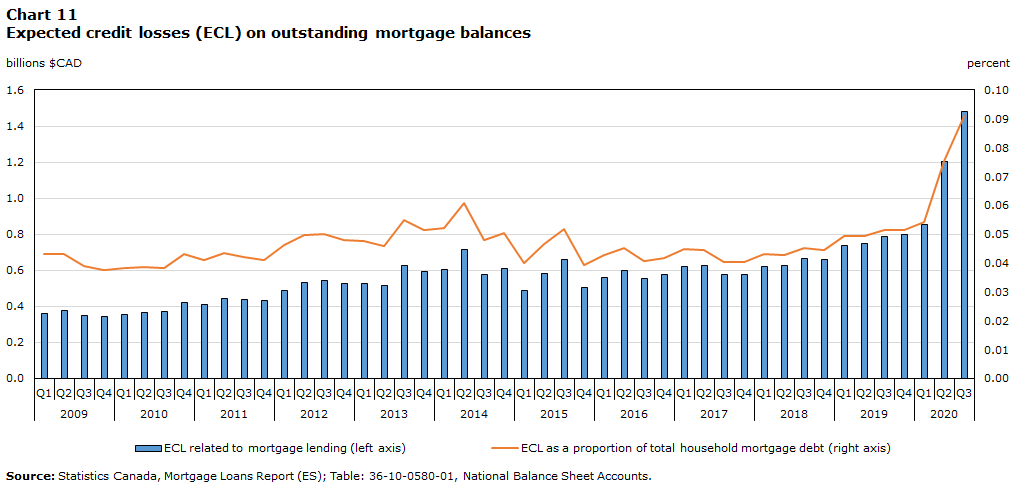

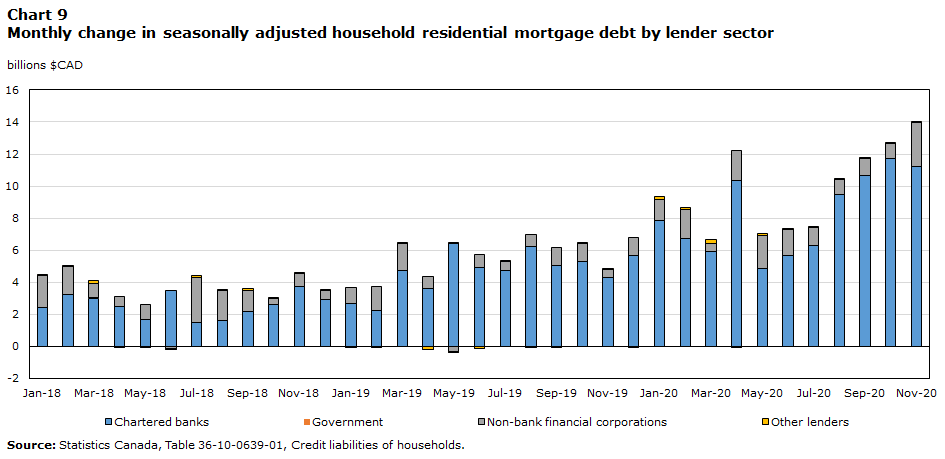

Trends In The Canadian Mortgage Market Before And During Covid 19

![]()

Mortgages For Newcomers To Canada Loans Canada

Types Of Mortgages In Canada And How They Apply To You Canadian Mortgages Inc

Types Of Mortgages In Canada Comparewise

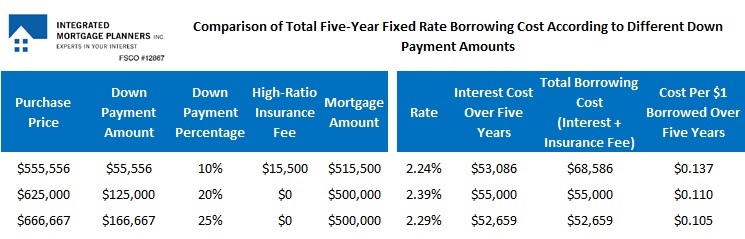

Canadian Mortgage Rates Explained Why A Smaller Down Payment Comes With A Lower Mortgage Rate Dave The Mortgage Broker

Economist S View The Role Of Securitization In Mortgage Lending

Trends In The Canadian Mortgage Market Before And During Covid 19

How Does A Mortgage Work In Canada

How Do Mortgages Work In Canada Canadian Real Estate Wealth

Mortgages For Newcomers To Canada Loans Canada

How Do Mortgages Work In Canada Canadian Mortgages Inc

Canada Mortgage Learn The Basics Youtube

Broker Lender Market Share Q1 2019 Mortgage Rates Mortgage Broker News In Canada

How Much Mortgage Can I Afford Ratehub Ca

Pdf Do Women Working In The Public Sector Have It Easier To Become Mothers In Spain

Types Of Mortgages In Canada Comparewise